Posts, Links and Thoughts From A Believer In Free Markets, Individual Responsibility, American Exceptionalism, A Strict Interpretation of the Constitution, The Right To Bear Arms and The Notion That More Government Can Only Make Things Worse

Wednesday, February 24, 2010

Obama The Hypocrite

“You know, the Founders designed this system, as frustrating it is, to make sure that there's a broad consensus before the country moves forward,” then-Sen. Obama told the audience.

His remarks have garnered some attention in recent days given the current likelihood that Senate Democrats will next week use “reconciliation” rules, which require only a 51-vote majority, to pass health care reform legislation, bypassing the current Senate rules of requiring 60 votes to cut off a potential filibuster and proceed to a final vote.

The White House has been in recent days setting the table for use of reconciliation rules for health care reform. White House press secretary Robert Gibbs noted that reconciliation rules were used for both of President George W. Bush’s major tax cut provisions in 2001 and 2003.

Tuesday, February 23, 2010

Political Dictionary

partisan bickering—a period when conservatives are unexpectedly gaining the upper hand.

gridlock—a time when liberal legislation polls less than 50% among the American people.

bipartisanship—triangulating Republican legislators who join liberals on key legislation.

filibuster—a sometimes necessary Senate remedy to thwart reactionary excess—in its perverted form, unnaturally turned on progressives.

centrist—a Republican who votes for Democratic-sponsored legislation; to be distinguished from an opportunist, who, as a Democrat, votes for Republican-sponsored legislation.

Monday, February 15, 2010

Saturday, February 13, 2010

Grow A Pair

It's become almost a competition within the Obama White House: who cam come up with the best way to blame a problem on the preceding administration. The variations on the theme have become cliche's so quickly:

"We have to clean up this mess..."

"We inherited this mess..."

"This was here when we walked in the door.."

"We have to overcome eight years of..."

"Our predecessors left us a worse mess than we thought..."

"This is a result of eight years of..."

And it's getting tiresome.

Hey, Mr. Obama, you're so damned smart, how come you didn't know any of this when you were running for office? Back then, you had all the solutions if we just trusted you.

You were going to reverse all our failures. Solve all our problems. Bring an end to bitter partisanship. Improve our standing in the world.

But now that you're actually expected to keep those promises, all of a sudden things are far more complicated and involved and challenging and generally worse than you thought.

But not worse than you told us. You made it abundantly clear just how badly eight years of Bush-Cheney had screwed us. It was a hell of a mess, but you were ready to clean it up. To coin a phrase, it was a shovel-ready project, and you had the shovel.

Instead, you've given us a steady stream of excuses and rationales and finger-pointing and more partisan rhetoric.

And how about those promises? "Closing the door to lobbyists." Except the couple of dozen you've appointed to powerful offices. "Closing Guantanamo within a year." Still open. "No tax hikes on people making less than $250,000." Whoops. "Unemployment won't go above 9 percent." That depends on how you define "percent," and if you're still operating on a Base 10 number system. "The most ethical administration ever." Unless you count things like paying your taxes.

Sheesh, you're acting like a guy who's never had a position of leadership or responsibility before, never really been held accountable for anything, never had to meet a payroll or be the boss.

Oh, that's right, you are.

If only someone had pointed that out when you were running for president.

Oh, that's right, a lot of us did.

But you won anyway. You're the president now. You wanted the office, you said you could handle it, you said you could do the job.

Start doing it.

If you can't grow a pair, then, sir, then at least act like it. Fake it if you must.

A lot of people start out faking it, then later discover that they actually can do the job. Give it a whirl.

And retire the "it's not my fault, it's the fault of the guy who had the job before" crap. Nobody forced you to take the job. Hell, there were a lot of other applicants for the job, and you told us all that you were better qualified and would do a better job than any of them.

And, for god's sake, even after the Massachusetts election, you STILL have a bigger majority in Congress than your predecessor ever enjoyed. Hell, in his last two years, your party held both Houses and you're STILL blaming him for everything.

You said you were ready "from day one" to be president. We're closing in on Day 400.

Start proving it.

John Murtha's Career As Seen By Liberal Media

Here’s a letter that I just sent to the Washington Post:

Your favorable front-page remembrance of the late U.S. Rep. John Murtha inadvertently testifies to the abysmally low standards to which politicians are held (“John Murtha dies; longtime congressman was master of pork-barrel politics,” Feb. 9). By your own account, Mr. Murtha was the “King of Pork.” He was known for skillfully using Congressional procedures to earmark funds for his district – that is, to prompt Uncle Sam to take money from Americans at large and give it to the relatively small number of Pennsylvanians who elect Mr. Murtha to office.

His justification? “I take care of my district.” Nothing here about spending taxpayer money wisely; nothing about the general welfare; nothing about principles or fiscal responsibility.

If Mr. Murtha on his own had traveled the country picking pockets, robbing banks, and burgling houses, only to bring the booty back to western PA and share it with his friends, he would have been rightly despised as a common criminal. But because Mr. Murtha joined forces with persons having similarly questionable morals, who together pass off their thievery as “lawmaking,” he’s celebrated in your pages – celebrated for doing, save on a grander scale, exactly what is done by common thieves.

Sincerely,

Donald J. Boudreaux

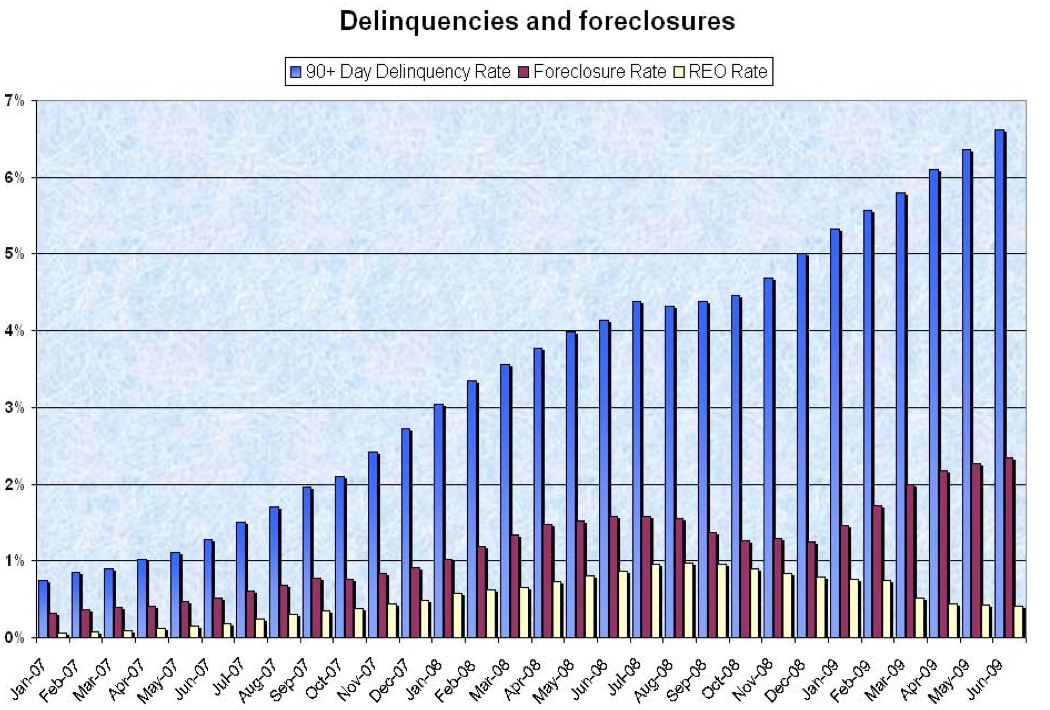

Housing Delinquencies and Foreclosures

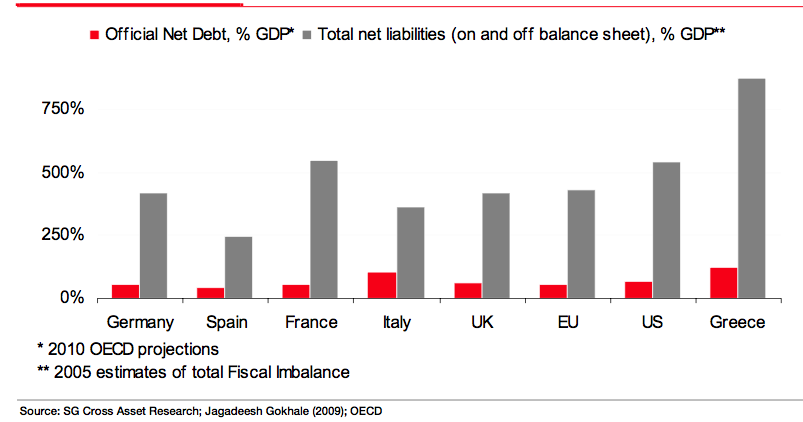

Off Balance Sheet Debt of Sovereigns

Wednesday, February 10, 2010

I Am Not Nuanced Enough To Understand Michelle Obama

Saturday, February 6, 2010

Tax, Tax and More Tax

Once upon a time, a man went to work and earned a dollar. He used the dollar to buy a share of stock. The stock paid a dividend of 10 cents a year, 10% being the going rate of return in the land.

Thanks to wise corporate management, the dividend eventually doubled to 20 cents a year, causing the stock price to double as well. The man sold his share for $2, which he put in the bank. Eventually, his children inherited the money and reinvested it in the same company. They used their 20-cent annual dividend to purchase goods and services, happily ever after.

That was a fairy tale. Here is the reality:

Once upon a time, a man went to work and earned a dollar. After paying state and federal income taxes, he was left with 50 cents. He used the 50 cents to buy half a share of stock. When the stock price doubled, he sold his half-share for a dollar, paid a 10-cent tax on the capital gain, and put the remaining 90 cents in the bank. Eventually, his children inherited the money, paid 50 cents in inheritance tax, and reinvested the remaining 40 cents in the original company.

The company continued to earn a 10% rate of return, of which half went to pay corporate income and excise taxes. The children therefore received an annual dividend of 5%, which came to two cents a year. After paying personal income tax on the dividend, they were left with a penny a year in income. They used part of that penny to purchase goods and services, and the rest to pay sales taxes.

Okay, that’s a worst-case scenario. There are many things the man could have done to reduce his family’s tax burden. He could have chosen an investment that paid no dividends. He could have held his stock instead of selling it, accepting some extra risk. He could have spent everything he had before he died. For that matter, he could have chosen not to go to work in the first place. But the fact remains that after a series of perfectly reasonable economic choices, this family lost 95% of its income to taxes.

Ninety-five percent! From 20 cents a year down to a penny! How could such a thing happen? Simple: by taxing the same income five times.

Some aspects of multiple taxation are widely recognized, but others aren’t. Everyone knows about the “double taxation” of corporate income: first when it’s earned and then when it’s paid out as dividends. But not everyone realizes that capital gains are always caused by expectations of future income. That means the capital-gains tax amounts to a third tax on income that’s already slated to be taxed twice. Taxing both dividends and capital gains is like fining drivers for speeding and then fining them again for

having a high speedometer reading.

More important, each of these taxes — along with the inheritance tax and, for that matter, any tax at all on capital income — is ultimately a disguised tax on labor. That’s because Marx was right: Capital is the embodiment of past labor. Today’s capital income is a deferred reward for yesterday’s hard work. Tax that reward and you’re taxing the work that made it possible.

A tax on capital — whether it comes in the form of a tax on dividends, corporate income, capital gains or inheritance — is equivalent not just to a tax on labor, but to a highly discriminatory tax on labor. It penalizes the labor of the young (who have many years of saving ahead of them) far more heavily than the labor of the old (who tend to spend their income as it arrives). So not only are people penalized for working, they’re penalized doubly for working early in life.

A tax on labor discourages work. A tax on capital discourages work disproportionately among the young, distorting saving decisions and retarding economic growth. So a tax on capital has all the disadvantages of an extra tax on labor, and more besides.

Moreover, a tax on capital is a deceptive tax. When your income is taxed on five separate occasions, you’re less likely to notice the bite than if it’s taken all at once. Arguably, that allows politicians to get away with higher total tax rates than if they were forced to operate in the open.

All of which suggests that we’d be better off with a single tax on labor income and no taxes at all on corporate income, dividends, capital gains or inheritance. A growing body of research in macroeconomics supports that suggestion. The main contributors to that research include Christophe Chamley of Harvard, Ken Judd of Stanford, Peter Diamond of the Massachusetts Institute of Technology, Patrick Kehoe at Penn, V.V. Chari at Minnesota and Robert E. Lucas at Chicago. Mr. Lucas is a Nobel laureate who has been recognized for 30 years as the world’s most thoughtful and influential macroeconomist. Here’s how he sums up the findings so far:

When I left graduate school in 1963, I believed that the single most desirable change in the U.S. tax structure would be the taxation of capital gains as ordinary income. I now believe that neither capital gains nor any of the income from capital should be taxed at all. My earlier view was based on what I viewed as the best available economic analysis, but of course I think my current view is based on better analysis.

Of course, further analysis will be forthcoming and the conclusions might change. But for now, the best thinking confirms common sense: Five taxes is at least four too many.

China's One Child Policy Causes Savings Glut

In my recent research paper with Xiaobo Zhang (Wei and Zhang 2009), we hypothesised that a social phenomenon is the primary driver of the high savings rate. For the last few decades China has experienced a significant rise in the imbalance between the number of male and female children born to its citizens.

There are approximately 122 boys born for every 100 girls today, a ratio that means about one in five Chinese men will be cut out of the marriage market when this generation of children grows up. A variety of factors conspire to produce the imbalance. For example, Chinese parents often prefer sons. Ultra-sound makes it easy for parents to detect the gender of a foetus and abort the child that’s not the “right” sex for them, especially as China’s stringent family-planning policy allows most couples to have only one or two children.

Our study compared savings data across regions and in households with sons versus those with daughters. We found that not only did households with sons save more than households with daughters on average, but that households with sons tend to raise their savings rate if they also happen to live in a region with a more skewed gender ratio. Even those not competing in the marriage market must compete to buy housing and make other significant purchases, pushing up the savings rate for all households.

More On Global Warming Hoax

And now, the science scandals just keep on coming. First there was the vast cache of e-mails leaked from the University of East Anglia, home of a crucial research unit responsible for collecting temperature data. Although not fatal to the science, they revealed a snakepit of scheming to keep contradictory research from being published, make imperfect data look better, and withhold information from unfriendly third parties. If science is supposed to be open and transparent, these guys acted as if they had a lot to hide.

Thursday, February 4, 2010

Obama Is Not Self-Aware

Incompetent Obama Administration

The good news is that, when it comes to reshaping the U.S. mortgage market [any market for that matter — ed.], the Obama administration’s top guns are bringing to bear all of the brisk, rough-’n’-ready entrepreneurial know-how they picked up in their previous careers as university professors, nonprofit activists, and holders of political sinecures.