Priced in gold, the median house bought 460 ounces of gold in 2001 and 490 ounces at the peak in 2005--a gain of 6%, considerably less than the nominal price in dollars.

Had a homeowner eschewed the blandishments of the housing bubble in 2001 and sold his/her home for 460 ounces of gold and rented for eight years, he/she could now buy a home for 160 ounces of gold and have 300 ounces in hand.

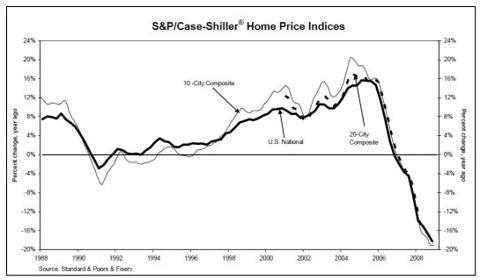

Here is a chart of the Case-Schiller Composite plotted in percentage points of rise or decline.

If we looked only at this chart, we might reach the conclusion that housing has "bottomed" and that it's "cheap." But if we price housing in loaves of bread or gold, we might reach a completely different conclusion: priced in commodities or gold, housing may not have reached its nadir, and other stores of value might retain more purchasing power than housing.

Should gold plummet, then of course housing would rise in relative performance even if it remained flatlined in nominal prices. If gold were about to fall dramatically, then this could be the relative valley in housing/gold valuations.

But the more likely scenario remains a continuing decline in nominal housing prices back to pre-bubble valuations. In this case, even if gold remains flatlined at $1,000 an ounce, then it will take fewer ounces of gold to buy a house in the future.

The point is to consider housing in relation to purchasing power/relative performance, not just in nominal dollar terms. Housing will always have value as shelter and land will always have value as productive dirt, but we must be skeptical of the constant hype that "a home is your best investment."

For the past eight years, when priced in gold, that has been patently false.

http://seekingalpha.com/article/163166-if-housing-were-priced-in-gold

No comments:

Post a Comment