Though less entertaining than the Iowahawk-inspired Bill Whittle video posted here a few weeks ago, the Wall Street Journal’s tax-the-rich exercise in an editorial this morning is nonetheless more instructive, as it deals with real numbers released by the IRS (bolds are mine throughout):

… imagine that instead of proposing to raise the top income tax rate well north of 40%, the President decided to go all the way to 100%.

… The mathematical reality is that in the absence of entitlement reform on the Paul Ryan model, Washington will need to soak the middle class—because that’s where the big money is.

Consider the Internal Revenue Service’s income tax statistics for 2008, the latest year for which data are available. The top 1% of taxpayers—those with salaries, dividends and capital gains roughly above about $380,000—paid 38% of taxes. But assume that tax policy confiscated all the taxable income of all the “millionaires and billionaires” Mr. Obama singled out. That yields merely about $938 billion, which is sand on the beach amid the $4 trillion White House budget, a $1.65 trillion deficit, and spending at 25% as a share of the economy, a post-World War II record.

Say we take it up to the top 10%, or everyone with income over $114,000, including joint filers. That’s five times Mr. Obama’s 2% promise. The IRS data are broken down at $100,000, yet taxing all income above that level throws up only $3.4 trillion. And remember, the top 10% already pay 69% of all total income taxes, while the top 5% pay more than all of the other 95%.

We recognize that 2008 was a bad year for the economy and thus for tax receipts, as payments by the rich fell along with their income.

Let’s stop there for a moment, because wasn’t quite as bad as the Journal indicates. Let’s never, ever forget that fiscal 2008 (I know, not the same as calendar 2008) was the highest year ever for tax collections, which included strong receipts during January-June 2008. Collections in April reached a single-month record of over $400 billion. About $95 billion in IRS stimulus checks should have been treated as outlays. When added to the $2.523 trillion listed in September 2008′s Monthly Treasury Statement, that yields a true total of $2.618 trillion. That’s the high-water mark for fiscal year collections. Individual income tax collections in fiscal 2008 (again adding back the stimulus payments) also reached an all-time record of $1.23 trillion. By contrast, individual income tax collections in fiscal 2010 were just under $900 billion, or over 25% lower than fiscal 2008.

Let’s stop there for a moment, because wasn’t quite as bad as the Journal indicates. Let’s never, ever forget that fiscal 2008 (I know, not the same as calendar 2008) was the highest year ever for tax collections, which included strong receipts during January-June 2008. Collections in April reached a single-month record of over $400 billion. About $95 billion in IRS stimulus checks should have been treated as outlays. When added to the $2.523 trillion listed in September 2008′s Monthly Treasury Statement, that yields a true total of $2.618 trillion. That’s the high-water mark for fiscal year collections. Individual income tax collections in fiscal 2008 (again adding back the stimulus payments) also reached an all-time record of $1.23 trillion. By contrast, individual income tax collections in fiscal 2010 were just under $900 billion, or over 25% lower than fiscal 2008.

I did look at 2007′s IRS info (accessible here), which showed $5.94 trillion in taxable income, so calendar 2008′s taxable income of $5.65 trillion was about 5% lower. If you think that dip is bad, wait until you see 2009, which won’t come out until later this year.

Skipping ahead to later paragraphs in the editorial:

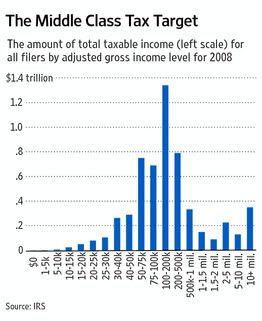

… in 2008, there was about $5.65 trillion in total taxable income from all individual taxpayers, and most of that came from middle income earners. The nearby chart shows the distribution, and the big hump in the center is where Democrats are inevitably headed for the same reason that Willie Sutton robbed banks.

… Mr. Obama is turning as he did last week to limiting tax deductions and other “loopholes,” such as for mortgage interest payments. We support doing away with these distortions too, and so does Mr. Ryan, but in return for lower tax rates. Mr. Obama just wants the extra money, which he says will reduce the deficit but in practice will merely enable more spending.

Keep in mind that the most expensive tax deductions, in terms of lost tax revenue, go mainly to the middle class.

… Mr. Obama’s speech was disgraceful for its demagoguery but also because it contained nothing remotely commensurate to the scale of the problem. If the President had come out for a large tax on the middle class, like a VAT, then at least the country could have debated the choice of paying for the government we have or modernizing it a la Mr. Ryan so it is affordable.

Instead the President will continue targeting the middle class for tax increases to pay for an entitlement state on autopilot, while claiming he only wants to tax the rich.

The best ways for the administration to raise tax revenue — even better than the long-term multitrillion-dollar bonanza available if we would just “drill baby drill” — would be to puncture the pervasive business-uncertainty overhang by promising (and keeping the promise) to stop micro-meddling in the economy, and to repeal Obamacare. Sadly, neither are going to happen.

"

No comments:

Post a Comment