Zero GDP Reading Exposes the Real Deficit – Economic Growth

February 1st, 2013It is currently in fashion to say, with great contrarian flair, that federal spending growth is the slowest since the Eisenhower Administration. Or, as someone famous recently put it, "We don't have a spending problem."

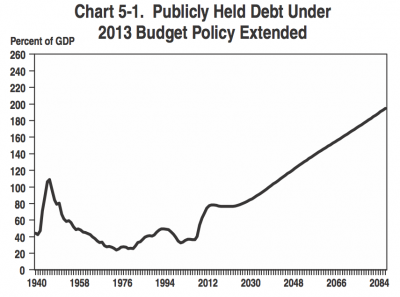

This assertion is, to put it mildly, debatable. Spending jumped 18% in just one year during the Panic of 2008-09. If the government keeps spending at that level, but starts counting after the jump, then the growth rate will appear modest. Spending as a share of GDP is higher than at anytime since World War II, and so is the debt-to-GDP ratio. As the OMB chart below shows, it gets much worse.

Nevertheless, does anyone disagree that we have a growth problem, and a serious one? Yesterday's negative GDP estimate for the fourth quarter of 2012 (-0.1%) should jolt the nation.

Let's stipulate the GDP reading's anomalies — lower than expected inventories and defense spending, which could reverse and add a bit to future growth. Yet economists had expected fourth quarter growth of 1.1% — itself an abysmal projection — and actual growth for the entire year was a barely mediocre 2.2%. Consider, too, that lots of economic activity was moved forward into 2012 to beat the Fiscal Cliff taxman. And don't forget the Federal Reserve's extraordinary QE programs, which are supposed to boost growth.

Whatever we're doing, it's not working. Not nearly well enough to create jobs. And not nearly well enough to help the budget. Because whatever you think about spending or taxes, the key factor in the health of the budget is economic growth.

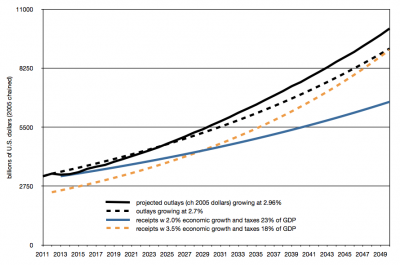

OMB projects spending will grow (from today's historically high level) around 2.96% per year through 2050. It projects annual economic growth over the period of 2.5%. That gets us a debt crisis somewhere down the line, and lots of other economic and social problems along the way.

Last year, however, keep in mind, growth was just 2.2%, following 2011's even worse reading of 1.8%. If we can't even match the modest 2.5% long-term projection coming out of a severe downturn, our problems may be worse than we think. Economist Robert Gordon of Northwestern asks "Is U.S. Growth Over?" Outlining seven economic headwinds, he projects growth of around 1.5% over the next few decades. In the chart below, you can see what a budget disaster such a slowdown would produce. Deficits quickly grow from a trillion dollars a year today into the many trillions per year.

Perhaps, many are now suggesting, we can tax our way out of the problem. Almost all academic research, however, suggests higher taxes (in terms of rates and as a portion of the economy) hurt economic growth. The Tax Foundation, for example, surveyed the 26 major studies on the topic going back to the early 1980s. Twenty-three of the studies found that taxes hurt economic growth. No study found higher taxes helped growth. Recent experience in Europe tends to confirm these findings.

Today, most of the policy discussion revolves around debt ceilings, sequesters, and the (fading) possibility of grand bargain budget deal. Mostly lost in the equation is economic growth. One question should dominate the thinking of policymakers: What policies would encourage more productive economic activity?

The new possibility of a breakthrough on immigration reform is an encouraging example. A more rational immigration policy for both low-skilled and high-skilled workers could boost economic growth significantly. Can we find more such policies? As you can see in the chart below, higher taxes can't make up the budget shortfall. Faster growth and modest spending restraint can. This chart once again shows the OMB projected spending path (solid black line). The solid blue line shows what would happen to tax receipts if (1) growth remains mediocre and (2) we somehow find a way to dramatically raise the portion of the economy Washington taxes from the historical 18% to 23%.

That's a major jump in taxation. Yet it doesn't get us close to a healthy budget.

Faster growth and modest spending restraint, on the other hand, close the budget gap. And they do so without increasing the share Washington historically takes from the economy. The orange dashed line shows tax receipts under an economy growing at 3.5% with the historic 18% tax-to-GDP ratio. (Growth of 3.5% may sound like an ambitious goal. Keep in mind, however, that we are still far below trend — we've never really recovered from the Great Recession. Long term growth of 3.5%, therefore, merely includes a more rapid recovery to trend over the next several years and then a resumption of the long-term average of 3%.) In the medium to long term, a faster growth-lower tax regime generates more tax revenue than a slow growth-high tax regime.

Faster growth alone would be enough to stabilize budget deficits at today's levels. But that is not enough. Trillion dollar deficits and Washington spending an ever rising share of the economy are not acceptable. Look, however, at the very modest spending restraint that would be required to essentially balance the budget by 2050. If we slowed spending growth from the projected 2.96% annual rate to just 2.7%, we could close the gap.

Does anyone think spending growth of 2.7% per year versus 2.96% is going to tear apart Social Security, Medicare, the military, or other essential government functions. Many of us could imagine responsible ways to reduce projected spending far, far more than that. All this shows is that a little restraint and robust economic growth go a long way.

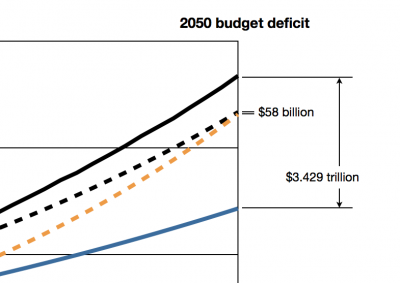

The slow growth-high tax scenario produces a budget deficit of almost $3.5 trillion in 2050. Under the faster growth-lower tax scenario, with a touch of spending restraint, the 2050 budget deficit would be just $58 billion.

Now, I'm not pretending I know that a higher tax-to-GDP ratio will produce a particular rate of economic growth. The above are just rough scenarios. Lots of factors are in play. And that is precisely the point. Given an complex, uncertain world, we should attempt to align all our policies for economic growth. We know what policies tend to encourage growth, and those that tend to stunt it.

That means getting immigration policy right — and it appears we may finally be getting somewhere. It means smart, reasonable regulatory policies in energy, health care, education, communications, and intellectual property. It means a healthy division of powers between the federal and state governments. And, yes, it means sweeping tax reform — both individual and corporate.

What we are doing today isn't working. We are on a dangerous path. Two percent growth won't get us anywhere. No matter how much we tax ourselves. Only robust growth fueled by entrepreneurship and investment, with a healthy faith in the unknown possibilities of America's future, will get us there.

Tags: budget, Economic growth, GDP, spending, Taxes

This entry was posted on Friday, February 1st, 2013 at 5:26 pm and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

Sent from my iPhone

No comments:

Post a Comment