On vested interests and profits

Jeremy Grantham as usual is the one to grab the public's attention whenever GMO produces a note. However, it must be said, Ben Inker's accompanying thoughts in the same edition are also worth some of your time.

Of particular interest, for example, is the following observation:

There are times when the markets do not seem to be following the script properly, and we are left wondering whether we are dealing with a temporary anomaly or a more permanent problem. Today we are faced with one of these problems: the persistently high profit margins of U.S. corporations. High profit margins should not persist in a mean-reverting world, and yet profitability in the U.S. has been higher than long-term averages for most of the last 20 years, oddly pretty close to the same length of time that the U.S. market has been trading above replacement cost.

And he goes on:

At first thought, it may not seem that odd that high profitability is associated with an expensive stock market – after all, shouldn't investors be willing to pay more for assets that achieve a high return? But high valuations imply a low cost of equity capital, which should encourage corporations to issue more equity, and a high return on capital should encourage corporations to do more investing. These pressures should gradually push the cost of capital up and the return on capital down.

But in the period since the mid-1990s, stock issuance has been down and corporate investment has fallen as well, in apparent contravention of the basic rules of capitalism. A high return on capital that occurred simultaneously with a high cost of capital – that is a market selling below replacement cost – would make sense because there is no discrepancy to arbitrage. The current situation is not supposed to happen, which makes it tricky for us to understand exactly when it will end.

So what is happening?

According to Inker, the issue can't be with the profitability equation. That holds true because it is an "economic identity" derived from the Kalecki equation.

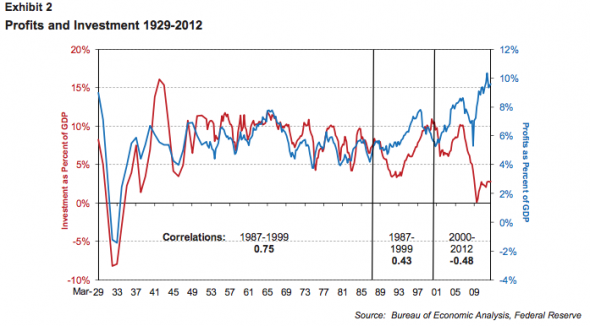

The problem is that the major driver of the ebb and flow of profits — investment — has started to break apart from its traditional relationship:

Investment used to be a good barometer for profit, the two used to be closely correlated. Since 1987, this is no longer the case. In fact, it's almost like less investment is leading to more profit.

As Inker notes:

Since 2000, investment has fallen off to levels lower than we have ever seen apart from the Great Depression, and yet profitability has risen to an all-time peak. This has been possible because other pieces from the Kalecki equation have kicked in in a way we haven't seen before.

Which raises the question of why corporations are investing less than at any point since the Great Depression.

Inker suggests it's almost as if corporations view their current profitability as a windfall rather than a permanent condition.

So does it perhaps come down to the case of vested interests? As Inker notes, the rich have been doing very well over the past 30 years, even in terms of their share of labour income. It is in some sense the rentier argument. Those who own the capital are seeing their wealth concentrate and have every interest in acting almost cartel-like.

Yet, as Inker also notes, an increasingly permanent upper class, which not only does far better in terms of labour income than the rest, but further accumulates a chunk of GDP in the form of persistently high dividends and stock buybacks, is likely to accumulate enemies.

Even if the rich avoid that, at some point this capital hoarding has to evolve into spending if profits are to stay high.

If not, there won't be any purchasing power. In that sense rising savings levels hurt corporate profits.

Of course, a lot of the wealthy like to save their income in the form of government debt — so part of the redistribution and purchasing power stimulation can come through government. But there is a problem if the government reaches a debt limit or is dissuaded from borrowing more because of austerity pressure. Which means…

If the rest of households stop dis-saving, it will require the rich to really up their spending to keep the system going. There may not actually be enough goods and services for the rich to buy to make this work, but even if it were possible, it would almost certainly increase the resentment of the have-nots until they took it out on them through the ballot box, if nothing else.

What Inker perhaps fails to recognise is that this may also be evolutionary game theory to some degree. There is now an interest in capital preservation, and the treatment of profits as a windfall, because capital itself is being compromised to some degree. More investment at this point may only lead to diminishing returns due to the general cornucopia referenced by Jeremy Grantham in his previous note.

The incentive for rentiers to game the system — by holding back investment — is now greater than the incentive than to add services and output. Profits in dollar terms can only be guaranteed by contracting supply, not adding to it.

To get all evolutionarily stable strategy (ESS) theory on it, vested interests currently have a greater incentive than normal to effectively engage in price-fixing behaviour. And the usual processes that insure price-fixing pacts are unsuccessful due to treachery from within (lack of cartel discipline) are lacking because the treachery has evolved, potentially towards a more collaborative non-dollar defined benefit system.

As anthropologist David Graeber notes in an equally "deep thinking" piece at the Baffler:

A renegotiated definition of productivity should make it easier to reimagine the very nature of what work is, since, among other things, it will mean that technological development will be redirected less toward creating ever more consumer products and ever more disciplined labor, and more toward eliminating those forms of labor entirely.

Related link:

Deep thoughts on civilisation from Jeremy "Hari Seldon" Grantham – FT Alphaville

Sent from my iPhone

No comments:

Post a Comment