Welcome to the 'Desert of the Real' — a postmodern economy

Volatility guru Christopher Cole, who heads up the volatility fund Artemis Capital Management, is known for making interesting arguments when it comes to volatility and risk. Previous philosophical thoughts have questioned the concept of volatility, proposed that risk itself is changing, and that QE and other forms of government intervention are warping volatility beyond recognition.

His latest note, though, takes us to an entirely new dimension of market abstraction.

Here's a starter sample:

Modern financial markets are a game of impossible objects. In a world where global central banks manipulate the cost of risk the mechanics of price discovery have disengaged from reality resulting in paradoxical expressions of value that should not exist according to efficient market theory. Fear and safety are now interchangeable in a speculative and high stakes game of perception. The efficient frontier is now contorted to such a degree that traditional empirical views are no longer relevant.

—

Likewise how certain are we that the elevated two-dimensional prices of risk assets and low spot volatility have anything to do with fundamental three-dimensional reality? In this brave new world volatility is an important dimension of risk because it can measure investor trust in the market depiction of the future economy. The problem is that the abstraction of the market has become an economic reality unto itself. You can no longer play by the old rules since those rules no longer apply. I know what you are thinking. You didn't get your MBA to be an amateur philosopher – your job is to make cold-hard decisions about real money – not read Plato. You are out of luck. For the next decade this market is going to reward philosophers over students of business. Why? Because the modern investor must hold several contradictory ideas in his or her head at the same time and none of them really make any sense according to business school case studies. Welcome to the impossible market where…

We, for one, like where he's going with this.

His point seems to be that it's not just a question of the old rules changing. More that we may be standing on the edge of a paradigm shift so unexpected that nobody has yet been able to imagine it. A shift, we dare say, that could take conventional business and investment practice and spin it on its head entirely.

For now that means volatility is both cheap and expensive, according to Cole.

In many respects it's a quantum investing universe.

This makes sense to us since it suggests that value itself can only really be determined by an independent observer, subjectively. Until it's observed, it can be both valued and not valued simultaneously. Or perhaps, weirder still, there is no universal value system at all?

If that's not mind-bending enough, here's some more reflective thought from Cole:

The perfectly efficient market is by nature random. When the market has too much influence over the economic reality it was designed to mimic, the flow of information becomes increasingly less efficient with powerful consequences. Information becomes trapped in a self-reflexive cycle whereby the market is a mirror unto itself. Lack of randomness ironically leads to chaos. I believe this is what George Soros refers to as "reflexivity". The impossible object is a visual example of reflexivity. Deeper dimension markets like volatility, correlation, and volatility-of-volatility are important because they measure our confidence in the financial representation of economic reality.

If financial markets are the mirror reflecting a vision of our economy third dimension markets measure the distortion in the reflection. If you are familiar with Plato's Allegory of the Cave volatility is best understood as our collective trust in the shadows on the wall. In the 1985 work "Simulacra and Simulation" French philosopher Jean Baudrillard recalls the Borges fable about the cartographers of a great Empire who drew a map of its territories so detailed it was as vast as the Empire itself. According to Baudrillard as the actual Empire collapses the inhabitants begin to live their lives within the abstraction believing the map to be real (his work inspired the classic film "The Matrix" and the book is prominently displayed in one scene). The map is accepted as truth and people ignorantly live within a mechanism of their own design and the reality of the Empire is forgotten (10). This fable is a fitting allegory for our modern financial markets.

To get all Matrix on this, it's like saying the market has a clear-cut choice to make. It can either continue to take the blue pill and fool itself into thinking everything is as it always was — despite the glitch in the Matrix that was 2008 — or dare to see the economic reality for what it is by taking the red pill.

Naturally, the risk associated with taking the red pill is impossible to quantify — it could, after all, compromise our very understanding of economic reality.

It's understandable, in that context, that dishing out the blue pill seems so much more palatable to so many. We've called this the makings of a Jedi economy. Cole, however, puts it this way:

In the postmodern economy market expectations are more important to fundamental growth than the reality of supply and demand the market was designed to mimic. Our fiscal well being is now prisoner to financial and monetary engineering of our own design. Central banking strategy does not hide this fact with the goal of creating the optional illusion of economic prosperity through artificially higher asset prices to stimulate the real economy. In doing so they are exposing us all to hyperreality or what Baudrillard called "the desert of real".

In Fed speak this is what Bernanke calls the "wealth effect" and during his September 13th press conference he explained the concept: "if people feel that their financial situation is better because their 401k looks better or for whatever reason… they are more willing to go out and spend, and that's going to provide demand that firms need in order to be willing to hire and to invest." (11) In the postmodern financial system markets are a self-fulfilling projection unto themselves while trending toward inevitable disequilibrium. While it may be natural to conclude that the real economy is slave to the shadow banking system this is not a correct interpretation of the Baudrillard philosophy. The higher concept is that our economy is the shadow banking system… the Empire is gone and we are living ignorantly within the abstraction. The Fed must support the shadow banking oligarchy because without it the abstraction would fail.

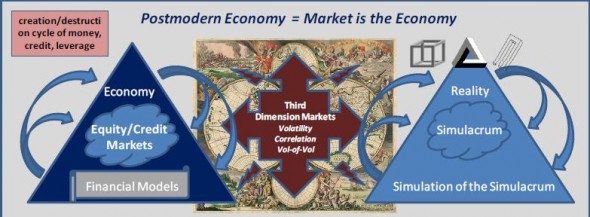

Meanwhile, a nice graphic to illustrate the economy's journey to the 'Desert of the Real'…

As to how this all applies to the price of volatility, the following is a useful excerpt (our emphasis)

When the market is an impossible object the price of risk can change radically as perception shifts. Hence what may be sound judgment one minute may be completely foolish the next. If two contradictory ideas can exist simultaneously then there is no such thing as "simple perception" anymore. How is it possible for safety to be risky and for otherwise calm markets to be rich in fear? Paradox is now fundamental. The investor who can adapt to shifting perspectives will endure the volatility of an impossible object. Common sense says do not trust your common sense anymore. Don't live in a box or walk a flight of stairs that leads back from whence you came. We cannot assume that the paradigm of the last three decades of lower interest rates and debt expansion will be relevant going forward nor can we find shelter in the consensus rules formed around that standard. Today's market is the most infinitely complex impossible object ever imagined and for the investor to thrive in it he or she must think creatively and be adaptable to the changing modes of acuity. You must be able to imagine different realistic states of the world and think as both the mathematician and the artist. Ironically he or she who plays it safe may be assuming the greatest risk of all.

In short, we're talking paradigm shift — if not the reassessment of what value really is.

Who knows, maybe in the new postmodern economy hyperinflation is a necessity. Deflation is a reality. And value itself is impossible to define monetarily?

Whatever the answer is, "prepare for the entirely unexpected" seems to be the message from the volatility markets according to Cole.

Related links:

Rubik's Revolutions - FT Alphaville

Jedi Economics - FT Alphaville

The calm before the (volatility) storm - FT Alphaville

A time of hoarding and inflation fears, 1930s edition – FT Alphaville

Is unlimited growth a thing of the past? – FT

Sent from my iPad

No comments:

Post a Comment